Transport Billing & Invoicing Recipient

Recipient Created Tax Invoices (RCTIs) or Reverse Billing

Generate tax invoices while maintaining oversight. Experience faster payments and reduced administrative workload without compromising accuracy.

Trusted choice by nearly 100,000 businesses

Transvirtual provides all the tools you need for easy invoicing

Before

Transvirtual

vs.

- Managing supplier invoices leads to delays and errors

- Discrepancies and mistakes

- Invoicing is restricted to direct transactions only

- Difficulty in tracking transactions and verifying details

After

Transvirtual

- Effortlessly create RCTIs or Reverse Billing, streamlining invoicing

- Automation reduces error

- Generate RCTIs for agents, carriers, or subcontractors.

- Generate comparison invoices in real-time for better accuracy.

Reduce the time spent managing supplier invoices.

Recipient Created Tax Invoices (RCTIs) or Reverse Billing

Sometimes it makes sense for you to create an invoice on behalf of a supplier. Save time reconciling and reduce risk of error.

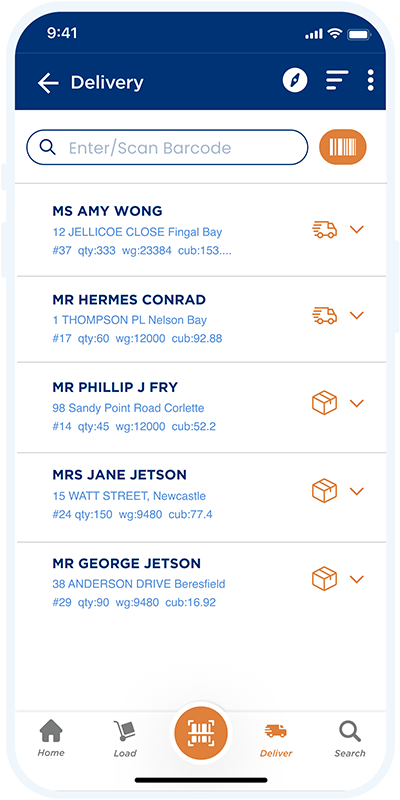

Generate invoices for others in your network

You can generate automated RCTIs for your agents, on-forwarders, carriers or subcontractors. It’s faster invoicing, with more control. Set it up and you’re good to go.

Enhance Your Customer Service Experience

Elevate your customer service by generating a comparison invoice in real time, allowing you to track and verify your transactions as they happen.

Join over 10,000+ ecstatic transport and logistics companies

Our transport solutions have over 500 configurable features designed to solve your most complex challenges

Our entire business has been positively impacted by the TransVirtual technology solution, it has allowed the business to scale without creating or increasing inefficient manual

processes.

Built for scale

Anthony Tanner

CEO, VT Freight Express

TransVirtual has reduced customer enquiries by 50% and given our customers full visibility throughout the delivery process. We have also been able to review set routes and find major

cost savings.

50% reduction in customer queries

Luke O’Shannassy

General Manager, Caledonian Transport

Automation prevented revenue leakage within the business, so a massive benefit for us from a profit perspective, that automation also allowed us to significantly reduce our staff headcount.

40% increase in revenue

Richard Tesoriero

CEO, Hunter Express

Our entire business has been positively impacted by the TransVirtual technology solution, it has allowed the business to scale without creating or increasing inefficient manual

processes.

Built for scale

Anthony Tanner

CEO, VT Freight Express

Automation prevented revenue leakage within the business, so a massive benefit for us from a profit perspective, that automation also allowed us to significantly reduce our staff headcount.

40% increase in revenue

Richard Tesoriero

CEO, Hunter Express

TransVirtual has reduced customer enquiries by 50% and given our customers full visibility throughout the delivery process. We have also been able to review set routes and find major

cost savings.

50% decrease in customer queries

Luke O’Shannassy

General Manager, Caledonian Transport

Frequently asked questions

An RCTI is a tax invoice created by the recipient of goods or services (rather than the supplier), commonly used in the transport industry where subcontractors perform deliveries. They’re necessary for simplifying the payment process, documentation, and maintaining tax compliance when working with multiple subcontractors.

When a subcontractor completes a delivery, instead of them creating an invoice, the principal company (recipient) generates the tax invoice on their behalf.

Our system automatically calculates the appropriate rates, GST, and any additional charges based on pre-agreed terms. This eliminates invoice discrepancies, reduces the administrative burden for subcontractors, and speeds up the payment process.

Both parties must have a valid written agreement in place before implementing RCTIs. This agreement needs to specify the terms of the arrangement, including agreed rates, payment terms, and GST requirements. Our system helps manage these agreements and ensures all RCTI documentation meets ATO requirements and industry standards.

Still have questions?

Speak to an expert

Let's solve your key challenges

Talk to one of our Transport Management System strategists to save you time and money. Your customers will thank you!

Book your strategy session now to:

1

Share your key problems

2

Receive high level solutions

3

As a good fit you’ll

book in a tailored demo