Last-mile delivery has become one of the biggest battlegrounds in logistics. And for good reason. It often makes up more than half of total delivery costs, even though it’s the shortest leg of a package’s journey. That means inefficient last-mile operations can eat into profits fast, while faster, more sustainable delivery can boost customer satisfaction and brand loyalty.

Today’s consumers expect speed, visibility, and convenience with every order, prompting companies to rethink how they deliver to your doorstep. Discover the key trends shaping last-mile delivery in 2026, from tech-driven innovation and electrified fleets to smarter rural networks.

The Last-Mile Delivery Industry So Far

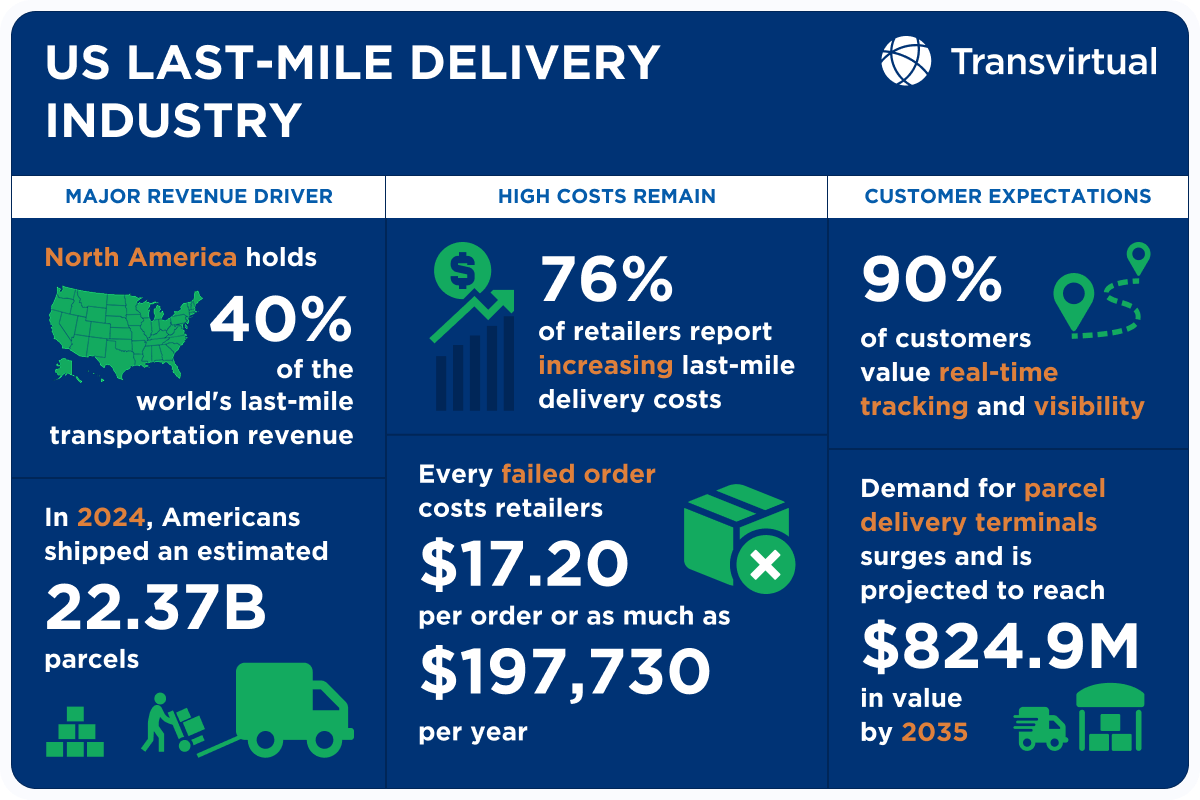

North America holds more than 40% share of the global last-mile transportation revenue, driven by ecommerce leaders like Amazon and the retail giant Walmart.

Huge parcel growth

Americans shipped 22.37 billion parcels in 2024, up from previous years as ecommerce demand continues to rise.

In 2024, USPS delivered 6.9 billion parcels, narrowly ahead of Amazon Logistics at 6.3 billion — with Amazon projected to surpass USPS by 2028.

Amazon’s logistics expansion includes a $4 billion investment to improve delivery coverage in rural America by 2026.

Cost pressures

Retailers report rising cost per package, with 76% saying last-mile delivery costs have increased and most seeing home delivery as unprofitable without efficiency improvements.

US delivery cost increased by an average of 12% from 2024 to 2025.

Location impacts costs. Urban deliveries usually cost $10 per package, while rural deliveries cost $50 because they typically cover longer distances.

The issue of costly failed deliveries remains. One failed delivery can cost retailers an average of $17.20 per order or around $197,730 per year.

Carrier network shifts

UPS is reducing its reliance on Amazon, planning to cut the volume it handles for the ecommerce giant by more than 50% by 2026.

FedEx and Amazon recently renewed a delivery agreement focused on high-margin and rural shipments, highlighting how carrier partnerships continue to evolve.

USPS opened its last-mile network via solicitations for all shippers, enabling same or next-day deliveries to reduce costs and generate revenue, reversing prior strategies.

FedEx’s Network 2.0 merged FedEx Express, FedEx Ground, FedEx Services, and other FedEx operating companies to eliminate redundant routes, which is expected to generate $2 billion of savings by 2027.

Customer expectations

Tracking and order visibility are important to 90% of customers, making real-time tracking a non-negotiable aspect of delivery.

However, 68% of US customers still prefer same-day delivery when available.

A survey by McKinsey on what US consumers demand from ecommerce deliveries reveals interesting insights:

Speed is less critical, with 90% of customers willing to wait 2 to 3 days for orders, as long as their packages arrive within the promised delivery window.

Slower delivery speeds are fine as long as their packages are delivered within the promised delivery window.

90% will abandon carts with costly shipping

More than a third will gladly pay extra for sustainable shipping

Flexible delivery options and return policies are crucial.

Parcel lockers and out-of-home pickup options are growing steadily in the US. The automated parcel delivery terminals market is projected to expand from $318.8 million in 2025 to $824.9 million by 2035 at a CAGR of 10%.

Key Last-Mile Trends and Innovation in 2026

Hyperlocal fulfillment and micro-fulfillment centers

The global FMC market is projected to reach $31.6 billion by 2030, a 31.1% growth from 2024.

Retailers are pushing inventory closer to customers to cut delivery time and cost. Micro-fulfilment centers, such as small, automated warehouses placed inside or near cities, are becoming a strategic advantage for same-day and even 30-minute delivery.

As labor costs rise and speed expectations increase, MFCs help retailers scale last-mile performance without expanding traditional distribution centers.

EVs in delivery fleets

Electrification is moving from pilot programs to real deployment. Major carriers are adding electric vehicles to reduce fuel costs, meet emissions targets, and comply with tightening regulations. One of them is the US Postal Service, which is currently operating more than 2,600 EVs to deliver mail. While EVs lower long-term operating costs, charging infrastructure and route planning remain critical challenges.

Parcel lockers and out-of-home deliveries

Out-of-home delivery is gaining traction as consumers look for safer, more flexible ways to receive parcels. Lockers and pickup points reduce missed deliveries, theft, and re-delivery costs, making them attractive for both carriers and retailers.

US locker networks are expanding in retail stores, apartments, and transit hubs. Currently, the country has 170,000 access points, with approximately 48,000 Automated Parcel Machine (APM) locations. This expansion has significant efficiency gains. A courier delivering to lockers can process up to 150 packages per hour, compared to 15 to 30 per hour for home deliveries.

Autonomous delivery: drones, robots, and automation

Autonomous delivery continues to advance through pilots and regulatory progress. Federal Administration Aviation frameworks, such as Part 135, are enabling controlled drone delivery trials, while sidewalk robots are being tested in campuses and urban zones. Widespread adoption, however, is still constrained.

Dynamic delivery models

Flexible delivery models help carriers manage fluctuating demand, especially during extended peak seasons. For example, UPS SurePost hands off last-mile to USPS when demands rise. However, USPS rate hikes (10.3%) and contract shifts ended discounts and prompted in-house redirects via improved algorithms.

What This Means for Last-Mile Logistics in 2026

Last-mile delivery has moved from a cost center to a competitive differentiator with rising parcel volumes, longer peak seasons, and higher customer expectations. By 2026, the businesses that perform best will be the most adaptable.

The trends shaping the last-mile delivery point are heading in a clear direction. Inventory is moving closer to customers while delivery networks are becoming greener and more efficient with EVs. Out-of-home delivery options like lockers are reshaping how and where parcels are received.

What matters most now is how these solutions work together. Last-mile success no longer comes from a single tool or tactic. It comes from building a connected delivery strategy that balances speed, cost, and convenience. Platforms like last-mile delivery software that come with features such as route optimization, real-time tracking, carrier integration, and more make it a breeze to manage your delivery’s final destination.

Frequently Asked Questions on Last-Mile Delivery Trends

Last-mile delivery is the final step in the shipping process, where a parcel is transported from a local hub or distribution centre to the customer’s doorstep or pickup point. It’s often the most expensive and complex part of the delivery journey.

Last-mile delivery involves smaller drop sizes, longer travel times, urban congestion, and high labour costs. Failed deliveries, rural routes, and customer expectations for fast shipping also drive costs higher.

Key trends include hyperlocal and micro-fulfilment centres, electric delivery fleets, parcel lockers and out-of-home delivery, autonomous delivery trials, and more flexible, dynamic delivery models.

Customers now expect real-time tracking, accurate delivery windows, flexible delivery options, and affordable shipping. While speed still matters, reliability and transparency are becoming just as important.